Super Bowl to Sofa Surfing: Are Pro Athletes Going Broke?

On September 15, 2011, headlines erupted with news that Super Bowl winner and retired Baltimore Ravens cornerback Chris McAlister was completely broke. The former National Football League (NFL) star who played in three Pro Bowls stood before a judge and pleaded for a reduction in his $11,000 per month child support payments. Within two years of retirement, he had gone from once having a $55 million seven-year contract to living in his parent’s house and allegedly trying to sell his Super Bowl ring on Craigslist.

How did this happen? How did he go from the Super Bowl to sofa surfing? Why does this happen so often to professional athletes, and how can this dangerous trend stop?

NFL Players Getting Sacked Off the Field

Many young athletes dream of going pro. The allure of fame and fortune is intoxicating. Yet for most, that dream does not become a reality. As we said in our article on student-athletes, only a small fraction of high school athletes make it to the college level, where they end up struggling to balance the competing demands of being both a student and an athlete.

For the lucky 1% of student-athletes that go pro, they may think they have finally made it. However, being a professional athlete does not guarantee long-term financial stability or happiness. Not all pro athletes make the big bucks or have lucrative contracts. Moreover, many retired players – from average players to NFL legends – face severe financial distress, unemployment, and divorce.

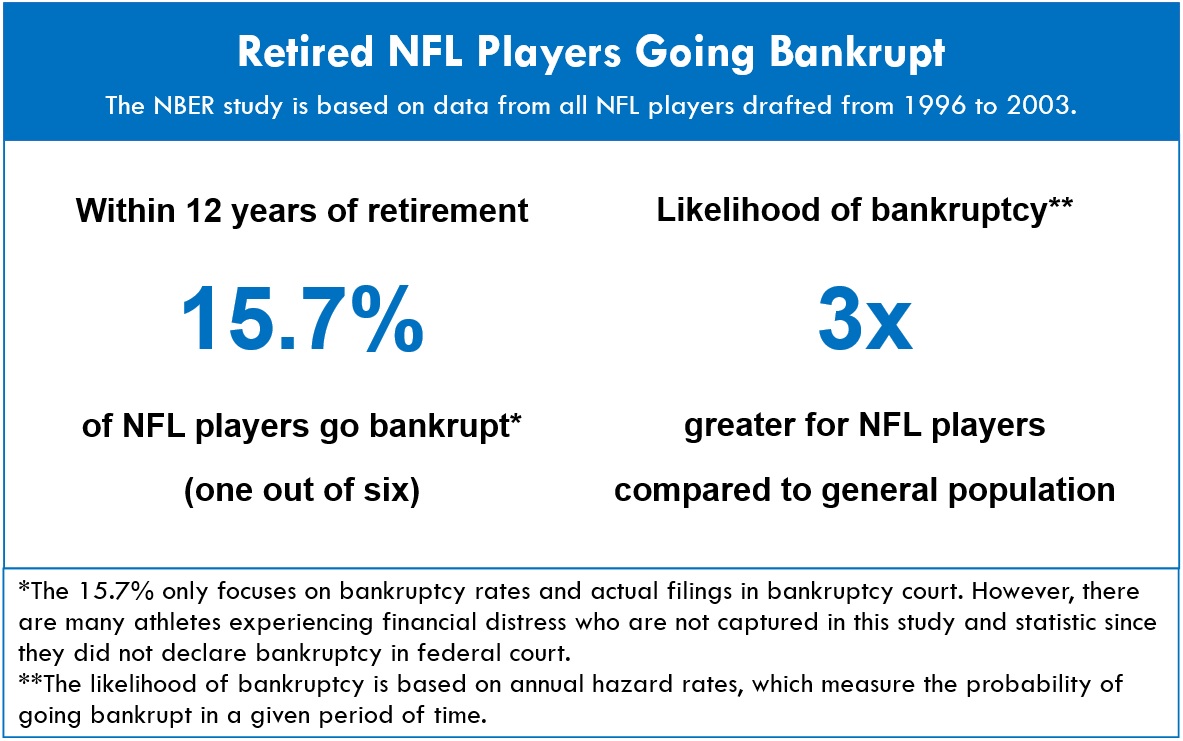

A popular 2009 Sports Illustrated article claims that within two years of retirement, 78% of NFL players are bankrupt or under “financial stress” – which is roughly four out of five retired athletes. A 2015 study by the National Bureau of Economic Research (NBER) offers a more modest but still alarming statistic. It found nearly 16% of former NFL players declare bankruptcy within 12 years of retirement.

The study showed that it does not matter how much money is earned or how many years an athlete plays in the pros – the high bankruptcy rate does not change. This means you can be Drew Brees or Tom Brady with huge contracts, big endorsement deals, and years in the game, and still be the one out of every six retired players in bankruptcy court. The study also found the likelihood of NFL players declaring bankruptcy is almost three times greater than that of the general population.

Source: National Bureau of Economic Research (2015)

NFL = Not For Long

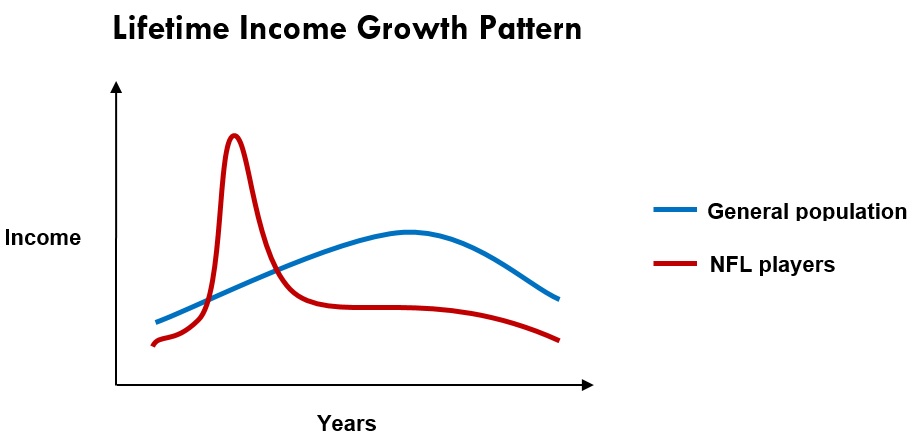

So why and how do these players end up in financial trouble? Pro athletes have an unusual income pattern where they earn a lot of money within a short time window when they are young, but then rarely make that kind of income again. Most people experience a continual upward income growth trend throughout their lives until they retire.

The atypical income path of athletes can make it hard for them to save. They need to live on a “financial diet” to make their money last 50 to 60 more years after they retire from sports. This is the only way to have a comfortable life and realize the benefits of all the hard work that got them to the pros in the first place.

The financial peak is sweet but short. Pro athletes have short-lived careers with the estimated average NFL career ranging from 3.2 years (NFLPA data) to 6 years (NFL data). Most players retire from pro sports by the age of 28 with little financial knowledge and limited job skills.

Our much admired heroes are struggling in everyday life, contrary to what the media publicizes. They deserve to be successful beyond the field and court, and they need the necessary financial guidance to avoid becoming yet another tabloid headline about a broke athlete.

CEO Money Without CEO Skills

The reality is that these athletes are making CEO money without the accompanying CEO experience and financial acumen. A 50 year-old who slowly increases his or her earnings over time has the opportunity to learn money management along the way. We cannot reasonably expect a 22 year-old to be skilled at managing a lot of money, which is often learned with age and wisdom. To bridge this knowledge gap, these players need reliable guidance from trustworthy people and a solid career transitioning plan.

Dana Hammonds, Director of Player Affairs and Development at the National Football League Players Association (NFLPA), said “the biggest issue for the athletes is understanding how long the money will last and not knowing when their careers will come to an end.” Players often spend big bucks because they are optimistic about their careers. All their lives they have been trained to bet on themselves and believe they are unstoppable. This “Superman Syndrome” is exacerbated through peer pressure to spend and live a flashy high-profile life.

While players live it up like they will always be earning millions, their sporting careers have an inevitable expiration date. Careers can be abruptly cut short when their bodies are put to the limit and they get injured. Serious injuries can leave players jobless and burdened with massive lifelong medical bills. Arguably, bargaining power is not in their favor, and thus football’s contract system does not provide enough income and job security for long-term financial stability. In the NFL, players can get cut if they are injured and many contracts have limited guaranteed money.

Don’t Try to “Get Rich” But Stay Rich

Since players spent most of their lives on the field instead of in the classroom, many lack the knowledge to plan their financial futures. Winfred Tubbs, a pro bowler who played seven seasons with the New Orleans Saints and San Francisco 49ers, said “there are a lot of people out there who can take advantage of you. I’ve had a couple of bad brokers.” Brokers and “friends” looking for easy money can present absurd business ideas – like proposing a Michael Jackson statue cologne to sell on home shopping TV channels to former wide receiver Muhsin “Moose” Muhammad. He did not invest in this laughable idea, but many players have been taken in by slick-talking carpetbaggers.

Instead of investing in lower-risk, more liquid investments like bonds or index funds, many athletes sink their money into riskier ventures. Tubbs explains that often they will put money into a restaurant or a real estate brokerage because “everybody wants a restaurant. It’s something that they can own, that they can show people, ‘I made it.’” Yet according to financial experts, roughly one in 30 of those investments actually work.

What pro athletes do not need are “get rich” schemes because many – but not all – of them are already rich. They need wealth preservation plans to stay rich. They are just too young and inexperienced to make their money last without credible guidance.

Financial Woes – A Pro Sport Norm?

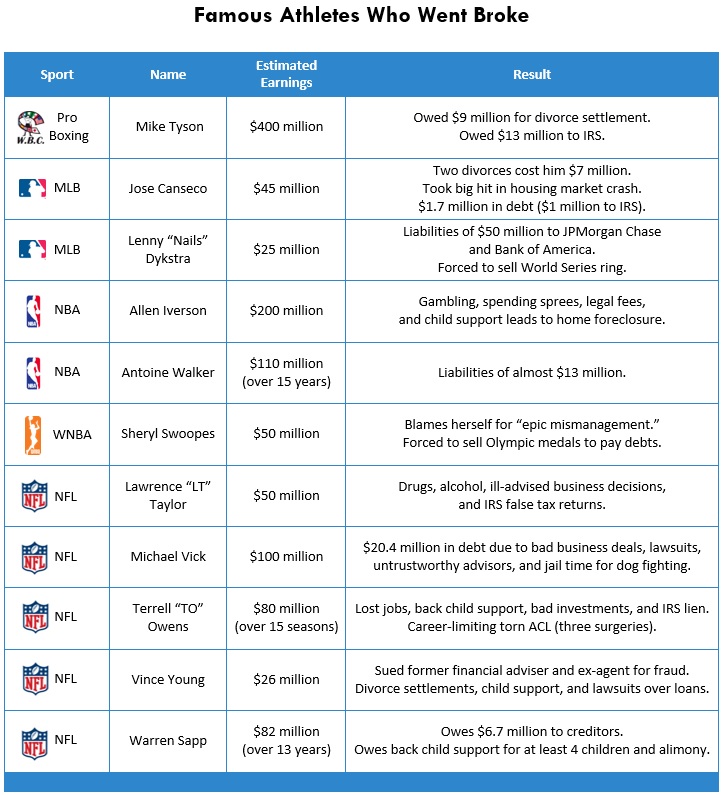

Although the NBER bankruptcy study focuses specifically on NFL players, financial ruin is common across all major professional sports. The chart below highlights some famous athletes who have struggled financially and taken some very big and public falls.

Source: ESPN (2012), Money Under 30 (2015), The Richest (2015)

Missing the Mark – Industry Initiatives Need Tweaking

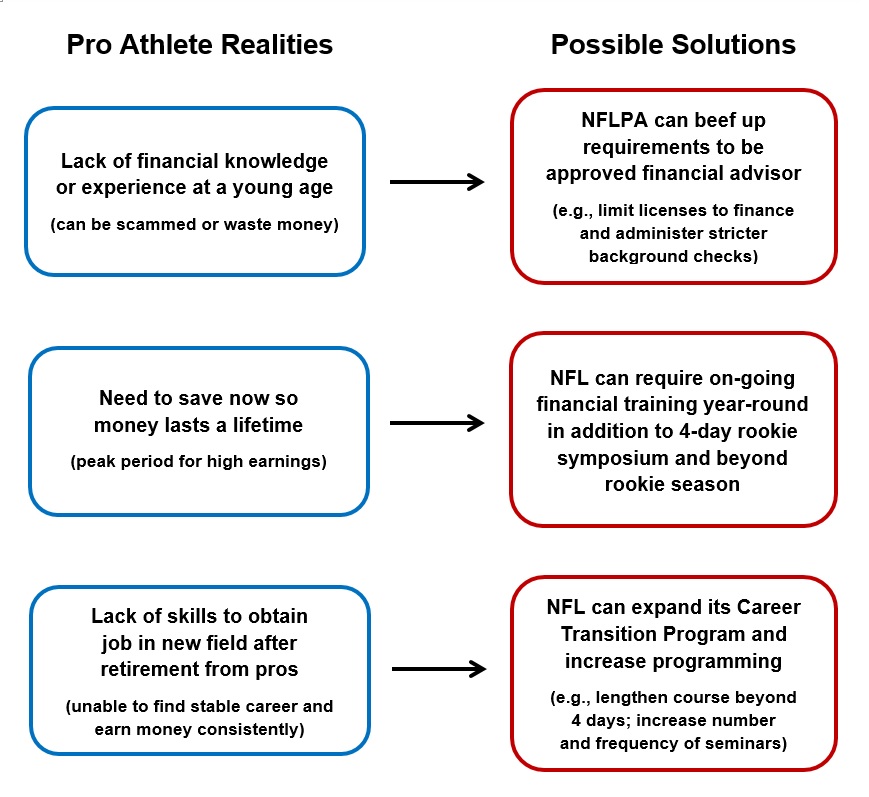

Knowing how hard pro athletes have worked to achieve greatness, seeing so many athletes struggle is heartbreaking. How can we help them realize their full potential in life after sports?

The need to improve financial literacy and money management skills has not gone unnoticed by the industry. The league and players association are trying to solve this pervasive problem. The NFL and NFLPA have implemented financial wellness programs to help players avoid bankruptcy. This is a positive move and shows critical leadership, but these valuable programs can be improved. To be more effective and increase their impact, these initiatives could be expanded to broaden their reach and scope. By building on these platforms, they could add programming at more frequent intervals to reach more players on a consistent basis and at all stages of their pro athletic careers. The goal should be to capture more players on their way in and way out of the game.

The NFLPA offers a list of registered financial advisors to athletes, but stricter standards are needed. Currently, background checks, a college degree, and eight years of licensed experience are required to be registered with the NFLPA. However, these requirements may not be enough to keep some sharks away.

Jeff Rubin and Kurt Barton – both of whom were registered with the NFLPA as approved financial advisors – orchestrated major financial scams. It is estimated that Rubin defrauded players out of over $100 million. He majored in Exercise and Sports Science in college and did not have any formal financial training. Barton, who ran a $50 million Ponzi scheme, attended but did not graduate from college. He allegedly lied to the NFLPA about having a college degree – which could have been easily verified with a simple phone call and a more rigorous background check. Stricter standards might have prevented these scammers from being registered and duping athletes out of their hard-earned money.

Best Defense is a Good Team Offense

To minimize future problems with financial advisors, one solution could be for the NFLPA to require a formalized education in finance (i.e., having a college degree or an MBA specializing in finance or economics). Another fix could be to narrow the scope of what kinds of licenses are allowed to qualify for NFLPA registration. Currently, the NFLPA has licensing requirements, but this licensed experience could include FINRA series licenses, being an attorney or CPA, or having an insurance license. A better approach may be to exclude advisors who are merely lawyers or in the insurance industry. The minimum hurdle should be being a licensed financial advisor working for a reputable company in finance and who is registered with the proper financial regulatory authorities.

To best support the players, the NFLPA may also need to strengthen its background check system if they have not already corrected what allowed Barton to slip through the cracks without a college degree. Perhaps the NFLPA should be held partially responsible in court if an approved advisor scams players when a thorough background check is not performed in accordance with its own certification process.

Players need to trust the NFLPA’s list of approved financial advisors. However, this needs to be balanced with the reality that the NFLPA is not in the money management business and can only do so much. If it were fully exposed to liability, then it would probably stop providing a list of NFPLA-certified financial advisors altogether. This would make players worse off.

In all fairness, we cannot ignore that good work is being done. The NFL and the NFLPA are moving in the right direction. They have passionate staff who care about these issues and are working diligently to make improvements. Examples of efforts to move the needle for athletes are the NFL’s Financial Education Program and the NFLPA’s new division called “The Trust,” which focuses on retired players and their post-pro transition.

The Azara Group is also dedicated to advancing the athletic and post-athletic careers of these champions. Career planning, business strategy, and negotiation skills are essential. In the case of pro athletes, a clear action plan for the future can help preserve their wealth. We believe in always being proactive and playing offense when it comes to the future. We help our clients strategize for career longevity and lasting financial success. These players deserve to live their dreams on the field and beyond, and our goal is to help get them there.

The Azara Group (TAG) is a consulting firm that promotes the development of leaders in an increasingly competitive and diverse marketplace – providing strategy consulting services and leadership training services to advance professional and life success. TAG leverages expertise in career strategy, diversity, negotiation skills, and business acumen to provide strategic advice and consulting services to help people and organizations get what they want, achieve their goals, and advance their business and career objectives. TAG also helps companies better attract, retain, and promote diverse talent, and develop robust diversity platforms and strategies to create a more inclusive workplace.

The Azara Group welcomes your direct comments and feedback. We do not post comments to our site at this time, but we value hearing from our readers. We invite you to share your thoughts with us. You can contact us directly at info@theazaragroup.com.

The Azara Group

The Azara Group